A quote from The US President’s Advisory Council on Financial Literacy goes: “Financial illiteracy is not an issue unique to any one population. It affects everyone: men and women, young and old, across all racial and socioeconomic lines. No longer can we stand by and ignore this problem.”

These words ring true even more today, as only two people in a room of ten have some form of financial literacy. This widespread ignorance concerning finance is troubling because there is no economy without people.

Immutable Ceenu is a free solution to this. In connecting users to investment tutors, Immutable Ceenu is the first step toward financial literacy. Registration is free, quick and easy. Keep reading to learn more about Immutable Ceenu.

Immutable Ceenu was made to plug the problem of financial ignorance. Generally, the average person finds it tough to access financial tutors. Immutable Ceenu brings investment educators and their firms, one step closer to the people.

Investment education is an integral part of financial enlightenment. The crucial and indispensable position of investments is a testament to this fact.

Immutable Ceenu is positioned as a link to investment education. It stands out as the average person's first step to financial literacy. All that's needed is to sign up.

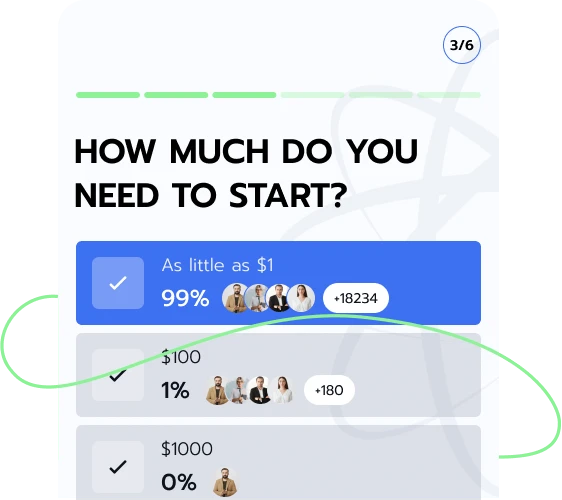

Registering on Immutable Ceenu is "as easy as pie." One doesn't need investment experience, upload documents, or pay registration fees.

All one needs to do is fill out the form on the website with the few details requested. It only takes a minute.

Visit the website and click the "register" button.

Fill out the form correctly with all the required details.

Wait for the response of an investment education firm's representative. Then begins the journey to financial literacy.

The Cambridge Advanced Learner's Dictionary defines investments as "The act of putting money, effort, time, etc., into something to capitalize on factors that can affect its value." Usually, there are no guarantees with investments.

Investments are an integral part of the economy. Studying investments is a great place to start understanding how the economy works. Immutable Ceenu links anyone willing to learn to investment educators. Here are some common types of investment:

They are also known as equities. They represent percentages of ownership of corporations. By extension, stocks represent a claim on a percentage of such companies' future earnings and returns. These investments usually come with market, liquidity, and company-specific risks.

Bonds are fixed-income investments. They are loans to a government, corporation, or private counterparty that allow for fixed interest payments over a specified time. Bonds are usually associated with interest rate, credit, and inflation risks.

Real Estate refers to any property acquired for possible long-term income should its value appreciate. Usually, this works with landed properties. Real Estate has risks, too. These include market risk, liquidity risk, damage risk, and others. Investments usually have the following characteristics.

Risk

Investment risk describes the potential for loss or fluctuation in asset value.

Horizon

A specific time delay before one may hope to receive returns.

Returns

Returns on investment could be possible income gains or losses.

Like farming, every investment must have some risk, a horizon period, and a season of returns. These characteristics impact the economy and investment performance. To learn more about this, sign up on Immutable Ceenu for free.

An investment educator is trained to help anyone understand the fundamentals of investments. Through unique student-centered means, they bridge the gap between complex financial concepts and everyday language, making investment education accessible and understandable for everyone. Investment educators play a vital role in promoting financial literacy, and Immutable Ceenu is a viable link to investment educators.

An investment educator's duties include informing students about the varying investment options on the current global economic scene, their applications, and their features. In doing this, an investment educator should be clear, concise, and comprehendible.

The investment educator must also provide practical tips and training to their students. They should teach how to read the trends of the investment-swayed economy and make informed decisions. Basic concepts such as risk management, long-term planning, diversification, divestment, and so on must be taught objectively.

Above all, the investment educator must teach the basics tailored with a student-centered approach. Financial concepts like budgeting, saving, and debt management must be communicated, considering the diverse needs of each student.

The fundamentals of investment education form the bedrock of understanding financial literacy for the everyday person. They include the tenets and crucial investment elements needed to give the student the insight to make informed financial decisions. The average person may handle the current global economic realities by learning these basics.

These fundamentals include learning about asset classes, risk and return relations, investment horizon, investment strategies, how to conduct research into current market dynamics, and so on. Immutable Ceenu remains a connector to investment education. The following explains a few fundamentals.

One basic tenet of investment education is learning about the available asset classes and the scope of their interactions with the economy. Understanding these asset classes or investment vehicles is one key to financial literacy.

Risk management, return allocation, and their relationship in the investment world must also be grasped as one of the fundamentals of investment education. These two elements make up two of the three crucial characteristics of investments.

Another fundamental of investment education is the balance of the investment time horizon. Like the concept of risk and return, the investment time horizon is one of the crucial characteristics of investments. The student must understand that every investment has market timing and impact.

Essential investment strategies equally applicable to everyday financial interaction are also fundamental to investment education. Strategies such as asset allocation, active, passive, value, growth, index, and so on are featured in suitable investment education.

Investments interact with the life of the average individual in various ways. These interactions have a significant impact, which manifests either directly or indirectly. The rise of socio-economic changes and innovations in a society with investment-backed companies shows how investments can impact lives.

By learning about investments and their interactions with everyone, average people will be able to make informed decisions. Registering on the Immutable Ceenu website is the first step to learning about investments. Immutable Ceenu links all registered users to investment educators.

Trading and investing are synonyms, usually for those who don't fully understand both concepts. They have their convergence and divergence points, which, without financial literacy, one may be unable to determine.

Both concepts are similar in the sales and purchase of asset classes. Both traders and investors operate in the financial market, which requires navigating risk and returns.

The differences show up when you consider the time horizon for both concepts. Trading is usually short-term, while investments are long-term. The focus of investment is the possible growth potential of asset classes, while that of trading is in the measurement of price movements. These and many more will be taught to users of Immutable Ceenu, a link to investment educators.

Investment risk refers to the likelihood of loss or the inconsistent changes in returns that an investment may experience. It’s crucial to recognize that all investments come with various risks, and the level of risk differs across investment vehicles.

This is the risk that interest rates, economic conditions, geopolitical events, or other market factors will negatively affect the value of an investment.

This risk refers to the inability to buy or sell an investment at a fair price due to market decline or low volume.

This risk occurs when an investor bears a loss when the contract's counterparty fails to remit interest or principal payment.

It is the risk of a decrease in the value of an investment due to currency value inflation.

This risk is best described by the idiom "Putting all your eggs in one basket." Focusing all resources on one investment class may be catastrophic should it fail.

This risk stems from the possibility that financial crises or market crashes may affect all the investments in the economy at the time.

Today's economy is no place to be ignorant. Leaving financial enlightenment to chance is a considerable risk to anyone who shares in the present day's limited resources, not to mention those who seek to invest what they've got.

Immutable Ceenu is a quick and easy solution to investment education. All one needs to do is sign up to get started.

| 🤖 Initial Cost | Registration is without cost |

| 💰 Fee Policy | Zero fees applied |

| 📋 How to Register | Quick, no-hassle signup |

| 📊 Educational Scope | Offerings include Cryptocurrency, Forex, and Funds management |

| 🌎 Countries Serviced | Operates globally except in the USA |